Project Overview

The Citizens Foundation (TCF) is an award-winning non-profit organization that builds and operates schools in low-income communities across Pakistan.

The organization faced challenges in global fundraising, notably around tax-deductible donations and donor engagement. I led the research, design, and roll-out of a Peer-to-Peer (P2P) fundraising platform between 2020 and 2021, aiming to streamline the donation process and ensure compliance with international tax regulations.

Timeline

2020-2022

My role

Product Manager

UX Researcher

Team

I conducted market research, user research, journey mapping, sketching, prototyping, user testing, and vendor management.

Collaborated with

- Marketing Lead for market and user research.

- UI Designer for high-fidelity prototypes and visual design.

- Technical Project Manager for running the development team.

My activities

As the project and digital lead in a scrappy nonprofit marketing team, my role was multifaceted. I was deeply involved in large portions of the project from conception to execution, especially in areas where digital and UX were key. At the same time ensuring cross-functional collaboration between marketing, developers, donor services, and fundraising teams was key.

I conducted research with donors, supporters, and staff to understand and map out the donor experience, created blueprints, user stories, and task flows to help buy-in with the technical teams as well as leadership.

Later, I worked with a technical project manager we brought on board to lead the new development team, including building out the roadmap and collaborating with stakeholders to ensure that the project aligned with both user needs and organizational goals, and was delivered on time and within budget.

Results

Through comprehensive user research and strategic product management, within 15 months of launch, the new platform resulted in over USD $1 million raised through supporter-created fundraising campaigns and streamlined the receipting and donor servicing process.

The Challenge

The project was initially envisioned solely as a P2P platform where we could consolidate TCF’s global digital fundraising. However, interviews with donors and staff revealed a crucial need: navigating the complexities of international donation processes. While this was not initially anticipated by the team, it became a crucial aspect of what we needed to address to meet the needs of our supporters worldwide.

Therefore the project aimed to tackle two distinct but related challenges:

1. Attracting and engaging donors

Attracting and engaging donors was a pivotal aspect of this project. The project aimed to not only attract new donors but also activate TCF’s existing network of supporters. The strategy was to engage these supporters in a more dynamic and participatory way, transforming them into active fundraisers and advocates for the cause. This involved creating an online platform that was not just donation-focused, but also enabled existing donors to initiate their own fundraising campaigns, thereby expanding TCF’s reach and impact.

2. Clarifying processes for international donors

Although headquartered and operating exclusively in Pakistan, TCF is supported by a sizeable donor-base of expats in other countries and relies on a network of partner organizations to assist with international outreach and fundraising. Each country has its unique tax laws, and the process of donating in a way that’s compliant and offers tax benefits can be unclear. We found that many international donors were unsure about where and how to donate to ensure their contributions were legal and tax-deductible in their respective countries.

The Solution

We designed and developed a custom-built Peer-to-Peer (P2P) fundraising portal and financial backend that routes online donations to the correct locally registered partner charity in the country where the donor resides. This helps donors make tax deductible online donations in the currency of their choice, while the organization is able to comply with the tax laws of each country in which it is registered as a nonprofit organization.

It also creates a unified platform that consolidates all online fundraising activities, showcasing the impact created by donors around the world. At the same time, it gives supporters of the organization a best-in-class online donation experience, engaging ways to create fundraising campaigns, and gives the backoffice team in each country the ability to seamlessly manage donor data in secure, isolated CRM systems.

You can visit the website at TCF Global.

Design Overview

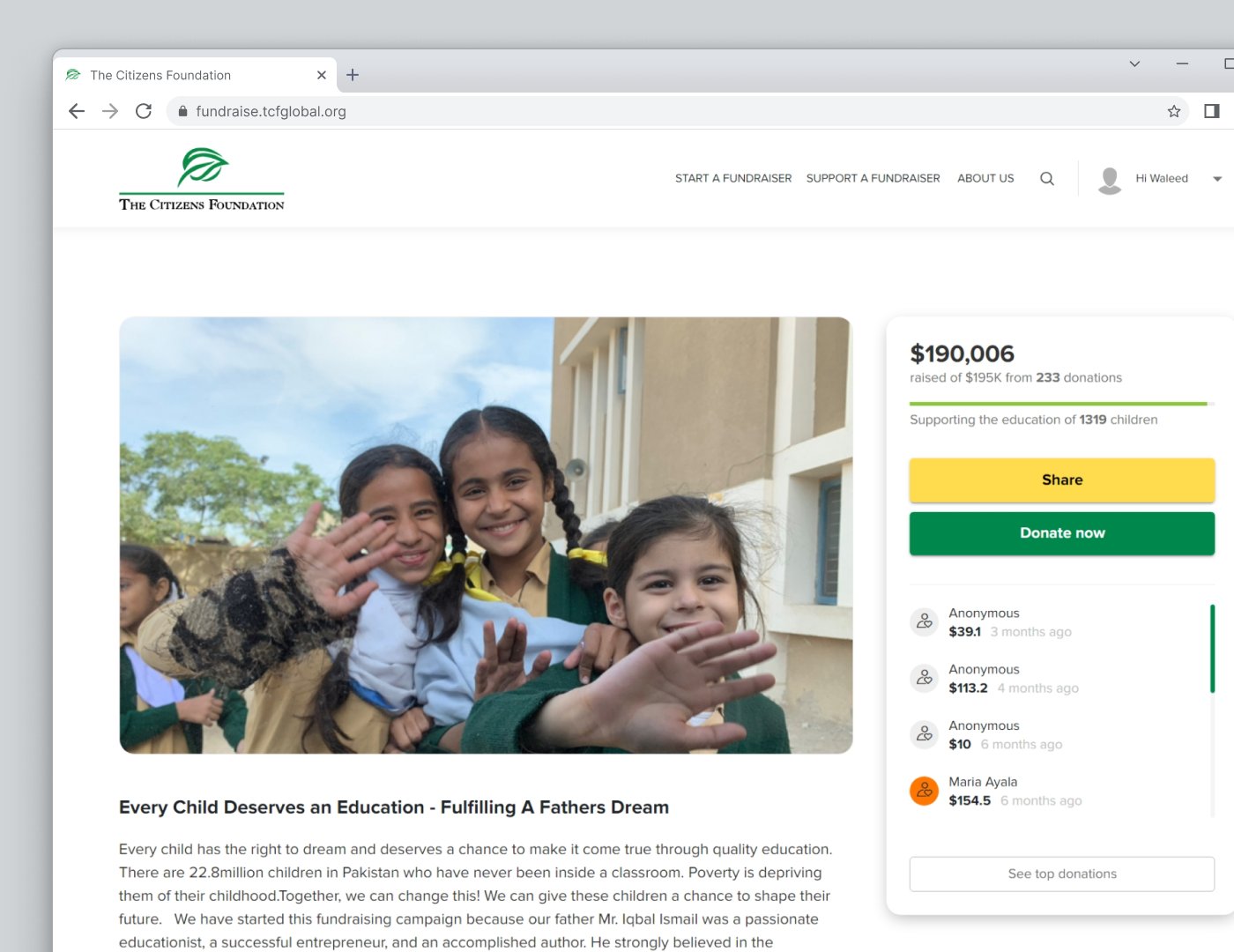

TCF Global is a Peer-to-Peer fundraising platform that encourages global participation amongst a community of supporters worldwide. Fundraisers can team up to raise funds to support the education of children from less privileged backgrounds in Pakistan, and share their efforts with friends and family worldwide.

The initial business objective was simple: activate TCF’s existing donors as advocates and fundraisers

Donors prefer Peer-to-Peer fundraising

Analysis told us peer-to-peer (P2P) donations accounted for nearly 40% of online donations, i.e. fundraising by supporters of TCF within their friends and family networks. These donations differed from ‘direct donations’ in the sense that they were received in response to an effort by a supporter of the organization (peer-to-peer), as opposed to some marketing effort by the organization itself (direct donations).

Locally in Pakistan, P2P fundraising was the fastest growing sector in terms of both number of new donors reached, as well as total funds raised. The organization wanted to capitalize on this growth in other markets.

About 40% of all online donations came from a peer-to-peer fundraising campaign [1]

A typical peer-to-peer fundraiser attracts 8 donations, with each donor giving an average of $30 [1]

76% of all donations to a campaign are made to individuals’ fundraising pages, not to the organization’s campaign page [2]

- Analysis of donations data for The Citizens Foundation 2018-2020

- 2020 Nonprofit Benchmarks. (2020). M+R Benchmarks Study 2020. https://2020.mrbenchmarks.com/

Research revealed several hurdles and points of friction for donors and fundraisers

Along with the marketing team, I conducted a series of interviews with donors, supporters who organized donations campaigns to support TCF, as well as internal fundraising staff with daily interactions with donors, we tried to understand the motivations behind why people supported the organization. We learned that the international donorbase and TCF’s corporate structure created several challenges.

Personal referrals were a main driver of online donations

Many donors gave to TCF because they had either already heard of the organization themselves or learned about it through friends and family.

Supporters hesitated to activate their global networks

Supporters around the world wanted to fundraise for TCF in their communities but hesitated due to questions around international donations.

No existing platforms offered the required level of control

Platform and digital infrastructure requirements meant none of the available turnkey fundraising platforms could fit the organization’s unique needs.

Understanding donor motivations

Over a series of interviews with donors, supporters who organized donations campaigns to support TCF, as well as internal fundraising staff with daily interactions with donors, we tried to understand the motivations behind why people supported the organization.

Donors are cause-driven, but also pragmatic

Many donors give because they are driven by a desire to make an impactful change through their charitable giving. However interviews with fundraisers and staff revealed that practical questions were a big part of the conversations they had with donors. Questions around tax incentives and social benefits, especially among expat donors, had a significant impact on the final decision to give.

A number of major expat donors reported confusion with this aspect, having to go through several hoops to ensure their donations were properly processed, receipted, and compliant with their local tax laws. A survey of online donors told us more than 50% had faced difficulties with this, e.g. having donated to a TCF partner organization in a different country, and thus not being able to file a tax-deductible receipt in their home country. From the organization’s standpoint, this resulted in significant legal and financial overheads due to the complexities of international funds transfers and compliance regulations.

Trusted referrals drive donations

Reputation and trust in the organization is a big factor. For donors, especially expats donating to a cause in their home country, knowing their donations are being utilized effectively and reaching the right people is key. Almost all donors we spoke to talked about how they came to learn of TCF through a trusted friend or family member who attested to the organization’s impact on the ground.

This personal endorsement aligned with secondary research findings: a report by Classy found that up to 70% of donors cite family and friends as their primary sources of information about new charitable giving opportunities.

Many of the learnings from my work in optimizing the online donations process helped inform our decisions going into this new platform, and you can read more about that for additional background.

The organization had unique platform requirements

As we began research on the existing fundraising and donation software suites, we quickly realized that TCF had some unique requirements that were not in the consideration set of any of the existing platforms.

Variety of preferred payment methods

While digital payments are on the rise in Pakistan, they still represented less than 10% of all financial transactions in FY2019-20. The low adoption was due to consumer distrust in online credit/debit card-based transactions and restrictive digital payments policies by the State Bank.

Consequently, there was an imbalance in the prevalence of digital versus traditional donation methods (like bank transfers, cheques and mobile wallet payments) between Pakistan and other countries where TCF raised funds. The proportion of cheque donations in Pakistan was nearly 50%, while some countries overwhelmingly preferred mobile wallet transactions – none of these payment channels could easily be integrated into existing systems.

Integration with financial institutions in Pakistan

Global Peer-to-peer fundraising platforms like CrowdRise, GoFundMe, or Classy offer integration with international payment processing services like Stripe and PayPal. These services allow funds to go straight into the organization’s bank accounts. However, options to process online payments in Pakistan are limited. Widely accepted payment processing services like PayPal and Stripe are entirely unavailable for settling in the country. Hence any off-the-shelf peer-to-peer fundraising solution cannot be used to collect online payments in Pakistan as they do not offer integrations with payment processing services or platforms available in the country.

A unified campaign view & isolated data in the backend

The platform needed to unify the view of TCF’s fundraising activities, integrating front-facing interactions with back-office functions for a comprehensive management system. This would centralize data, provide real-time insights, and streamline operations. A critical requirement was safeguarding donor data between Country Partners and employees, a feature not available in existing platforms.

No existing software platform offered a global account where fundraising efforts could be pooled in this way, while at the same time routing donations to different organizations to aid tax-compliant receipting. Individual, isolated websites for each organization could be built, but this would not offer a consolidated view of global fundraising for TCF.

Build or Buy?

After compiling a list of leading donor-management and fundraising software companies, I coordinated conversations and demos with their customer success teams and our donor services lead. However we quickly learned that their platforms were simply not designed for the kind of use-case we had in mind, and our volume was not sufficient for them to consider making the changes we needed.

We faced a pivotal decision: build our own platform or buy an existing solution. Building meant a substantial investment and additional responsibilities for our digital team, but offered customization and direct control over functionality. On the other hand, buying a ready-made solution would be less resource-intensive upfront but could involve compromises in features and adaptability.

Fees and Pricing

Peer-to peer fundraising services usually charge a platform fee. This fee is either based on flat-rate subscription charges or percentage-based pricing model which sometimes can go as high as 5%-7% of the total funds raised. Online payment processing services also charge a fee that varies according to the donors’ location and currency. In addition, integration with existing CRM, accounting, or marketing tools would require additional development work billed at steep hourly rates.

A bespoke solution for TCF can help the organization avoid some of these charges. TCF will also be able to keep almost 100% of its donation money raised through its supporters globally.

Our team decided to propose building our own platform. This was a difficult decision that we worked on justifying because it involved a significant investment in terms of both funding the project as well as carving out time from an already stretched digital team.

This allowed us to make the case for an owned platform that could provide:

Customization and control for complex requirements

The unique challenges of managing international donations and tax compliance necessitated a bespoke solution, tailored to TCF’s specific needs.

Long-term scalability and global campaigns

A self-built platform would be more adaptable to each market TCF fundraises in, as well as allow digital rollouts where the team was not already present and active.

Integrating with existing systems and practices

A custom-built platform could integrate with TCF’s existing CRM and payment platforms, crucial for maintaining continuity and efficiency in donor management and transaction processes.

Designing the P2P Platform

Mapping a Service Blueprint to understand problem areas

It became clear that there were a lot of processes and overlaps occurring between teams. I worked with the donor services team to understand all the steps involved with processing a donation to create a service blueprint. Creating this comprehensive view, particularly for international online donations offered a detailed view of every step in the donor journey, especially the complexities in the backstage and support processes.

A service blueprint based on an international donation. The circled area highlighted the additional backstage processing involved with each donation which we focused on simplifying. View larger in Figma.

Our focus was on rectifying the overlaps between country partners which led to CRM confusion—specifically, clarifying who owns donor accounts, who should communicate with donors, and the receipting process. It highlighted how such overlap could lead to miscommunications with donors, potentially escalating into financial and legal issues, especially because of the international transactions involved.

The new platform aimed to clarify this by delineating clear ownership, standardizing and automating these procedures, ensuring a seamless experience without the previous miscommunication and confusion not just for the donors but for the donor services and fundraising teams as well.

Designing the system helped reach common understanding from the outset

To help visualize how we wanted the system to behave, I mapped out high-level overviews as well as individual task flows. This allowed us to discuss the idea in detail with our Finance and Legal teams to ensure compliance from the start, and also helped us get buy-in from leadership in all organizations.

Technical discussions with Finance and Legal

The system overview was instrumental in our dialogue with Finance and Legal teams, aligning the platform’s design with compliance frameworks right from the conceptual stage.

Buy-in with leadership

The clarity provided by the overview also proved crucial in securing buy-in from leadership across all partner organizations, laying a solid foundation for collaborative development

Scouting Development Partners

We were also evaluating potential development partners at the time and this helped in selecting a partner equipped to address the specific challenges we identified.

Designing task flows for different kinds of users helped uncover additional nuance

We were designing for 3 different user roles, and so I collaborated with the team to create user flows for each.

Donors

Individuals looking to contribute financially to TCF. Their user flow includes discovering campaigns, deciding to donate, processing payments, and receiving confirmations.

Fundraisers

Supporters who create and manage fundraising campaigns. Their flow involves setting up campaigns, sharing with their network, and tracking contributions.

Donor Services staff

The team responsible for managing donor interactions, processing donations, and maintaining donor relationships. Their user flow is focused on backend management, support, and reporting.

Offline payment methods are extremely popular in Pakistan, a huge part of the fundraising market for TCF. As much as 50% of donations came through offline cash or cheque pickup requests, owing primarily to the aversion to online card-based donations, especially for large donations (see above). Although this number was dropping annually, we still wanted to ensure our platform could handle this kind of donation, so designed a verification flow where the Donor Services team could track and verify this activity using the online portal.

Clarifying Language

Since this was a new platform altogether, we also had to consider the language and UX writing. I worked closely with the marketing team, who had lots of experience crafting impactful messages. I contributed to shaping the initial language they created and actively tested various phrasing to ensure clarity and effectiveness. This helped us reach a good balance between their communications expertise and my focus on user experience, optimizing the language for both engagement and conversions.

We kept things straightforward. Our texts clearly explained how donations were routed as well as their impact, simplifying the decisions donors needed to make. We fine-tuned CTAs and added microcopy in various points along the process for better conversion, ensuring they were direct and easily actionable. Some examples:

Informing donors about where their donations go

A dropdown lets donors choose the country where their contribution goes

Donors almost exclusively made online transactions in their “home currencies”, i.e., the currency of their country of residence. In light of this insight and to comply with legal requirements, we tied the currency of the online donation to the organization that would receive the funds. This meant that any donation made in US Dollars would be routed to TCF USA; donations in Pakistani Rupees would be routed to TCF Pakistan, and so on.

Clarifying this was a large part of the user tests we ran, and we went through several variations to test which would clarify the flow of funds in the clearest manner. We conducted usability tests and think-aloud observations of volunteer donors to test their understanding of the language and UX of switching between currencies and how that would affect where their donation was going.

Informing donors of the impact of their donation

Language clarified the impact of each fundraiser and donation. The yellow part of the bar shows how much this particular donation is adding to the total fundraiser goal.

Donors wanted to know how much of an impact their contributions were making. We created the calculation for how many students their donations would support. We collaborated with the donor services and operations teams, which had predefined rates for the monthly or annual cost of educating a child in TCF schools. Therefore, this calculation would change based on the amount as well as whether the donor was giving a one-off donation or giving monthly.

Informing and encouraging fundraisers of their progress

We created email sequences based on various triggers that would communicate progress to fundraisers and confirming actions for donors. This aimed to maintain user engagement and build trust, supporting the ongoing relationship with the platform through each user’s journey. The triggers were chosen to coincide with critical points, to maintain momentum and a sense of achievement.

Testing with Users

We created wireframes and hi-fidelity mockups for basic validation with executive leadership, supporters, and legal counsel, and conducted over 40 hours of user interviews to match our UX learning from previous projects with best practices in online P2P fundraising.

Testing with Users throughout the process helped keep us on track

Incorporating lean user testing at each stage helped us ensure that we remained agile and responsive especially given this was a big project for the organization and the team was largely resource-strapped. We had different user groups with different needs and expectations: donors, supporters, fundraisers, as well as fundraising staff both in our core headquarters team, but also the remote teams operating in different countries – so we spoke to each often. We created wireframes and hi-fidelity mockups for basic validation with executive leadership, supporters, and legal counsel, and in total conducted over 40 hours of user interviews to match our UX learning from previous projects with best practices in online P2P fundraising.

“Quick and dirty” user testing isn’t all that dirty

Iterative user testing helped us validate our design and system architecture continuously, ensuring that each aspect resonated well with users’ expectations and needs.

In a lean team environment, rapid and “quick and dirty” testing methods were crucial. They allowed us to gather actionable insights swiftly without overburdening our resources.

Audiences varied in their expected levels of fidelity

We discovered the appropriate fidelity of our prototypes through trial and error. Higher-fidelity prototypes were necessary for some stakeholders to understand the interface and flow, while others could engage with lower-fidelity sketches.

Determining the level of detail needed in our prototypes for different stakeholders was pivotal. We learned which visual tools each stakeholder group required to understand and provide meaningful feedback on the project.